The Average Life Expectancy is Gradually Increasing

Living Longer Means Your Retirement Funds Must Last Longer

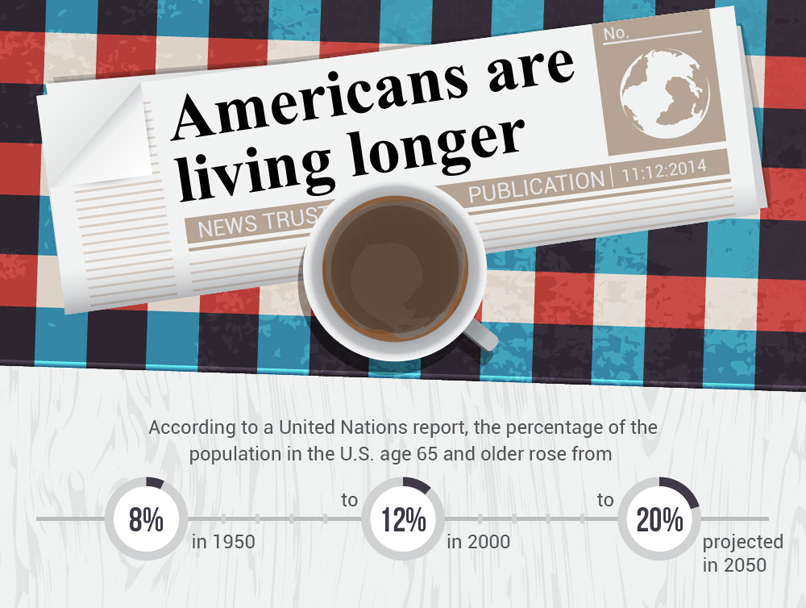

According to multiple studies, the number of Americans who are 65 or older has increased nearly tenfold in the last 100 years. While senior citizens are living longer, our aging population also in better shape, better health and in more comfort than the generations that preceded them.

Consider this sobering statistic: Most children born around the turn on the century--1900--did not live past the age of 50. As of 2012, the average life expectancy had skyrocketed to 78.8 years. Today one in ten girls is now expected to live past the age of 100. One in twenty boys will also live to see 100. Thanks to the additional investments in medical research, universal health coverage, and overall health care services we're likely to see this trend continue.

It goes without saying that while this is fantastic, it does call for increased financial planning and monetary diligence.

According to many studies, an increasing number of older workers plan to continue working for as long as they possibly can. The idea is that this will offset the cost of daily expenses and long term health care over a longer time period. As an example, in 2012 nearly one third of people between the ages of 65 and 69 were still working at least 10 hours each week. This is an increase of more than 26 percent since the same population was surveyed back in the year 2000.

Health care costs are another reason seniors are electing to stay in the workforce longer, as nearly one half of those 65 and older will end up paying some form of out of pocket expense for their long term care. As proof, in 2013 seniors paid a whopping $59 billion out of pocket for long term services while private insurers paid out just $25 billion.

The numbers don't lie. Long term care is expensive, and seniors must find some way to bridge the financial gap.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Financial planning is key to a happy fulfilling retirement. When planning for your future, you will want to stash away enough to at least maintain your current living standards plus inflation and future medical expenses. Social Security alone will not be enough for future generations. Start saving for retirement as early as you can and seek professional advice from a financial planner.

If you are already looking for senior housing for a loved one or yourself, Alternatives for Seniors may be able to help. Call one of our Information Specialists at Alternatives for Seniors: (888) WE-ASSIST. Our knowledable staff will help you find senior housing that fits your needs, desires and budget. You can also search for senior housing, senior care and services such as lawyers and financial planners on AlternativesforSeniors.com. Remember, a little planning today to save you or your loved ones stress in the future.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Thank You to Our Guest Blog Writer:

Amelia T. Humphrey

PO Box 70207

San Diego, CA 92167